How Retriever’s Buyer's Choice Program Helps Businesses Eliminate Payment Processing Fees

The Rising Cost of Payment Processing

For businesses of all sizes, credit card processing fees can be a significant burden, eating into profit margins and making it difficult to scale. With the increasing use of cashless payments, many businesses feel trapped, forced to absorb these fees just to remain competitive.

That’s where Retriever’s Buyer's Choice Program comes in. This innovative solution helps businesses eliminate payment processing fees while staying compliant with industry regulations. If you're looking for a way to keep more of your revenue without raising prices, Buyer’s Choice is the solution you've been waiting for.

What is Retriever’s Buyer's Choice Program?

Retriever’s Buyer’s Choice Program is a merchant processing solution designed to offset credit card processing fees, allowing businesses to keep more of their earnings.

How Retriever’s Buyer's Choice Program Helps Businesses Eliminate Payment Processing Fees

For businesses of all sizes, credit card processing fees can be a significant burden, eating into profit margins and making it difficult to scale. With the increasing use of cashless payments, many businesses feel trapped, forced to absorb these fees just to remain competitive.

That’s where Retriever’s Buyer's Choice Program comes in. This innovative solution helps businesses eliminate payment processing fees while staying compliant with industry regulations. If you're looking for a way to keep more of your revenue without raising prices, Buyer’s Choice is the solution you've been waiting for.

What is Retriever’s Buyer's Choice Program?

Retriever’s Buyer’s Choice Program is a merchant processing solution designed to offset credit card processing fees, allowing businesses to keep more of their earnings. Instead of covering these fees themselves, businesses can pass the cost to customers who choose to pay with a credit card while offering an incentive to those who pay with cash or debit.

The program ensures businesses remain fully compliant with card brand regulations, offering a seamless and transparent pricing model that both businesses and customers can understand. Unlike traditional surcharge programs, Buyer's Choice is structured to work across a wider range of industries, helping businesses reduce costs without violating any processing rules.

How Buyer's Choice Eliminates Processing Fees

Credit card companies charge businesses a percentage-based processing fee for every transaction, often between 2-4%. Over time, these fees add up and significantly impact revenue. Retriever’s Buyer's Choice Program helps merchants eliminate these fees by adjusting pricing models based on the type of payment customers use.

Here’s how it works:

- Customers paying with cash or debit receive a built-in discount at checkout.

- Customers who choose to pay with a credit card cover the associated processing fee as part of their total transaction.

- The process remains transparent at checkout, with clear pricing displays to ensure compliance and customer awareness.

By shifting the cost to those who choose to use credit cards, businesses no longer absorb processing fees, allowing them to reinvest their earnings into growth, marketing, or improved customer experiences.

Why Businesses Are Switching to Buyer's Choice

Increased Profit Margins

Without processing fees eating into every sale, businesses can keep 100% of their revenue on non-credit card transactions. Over time, this adds up to thousands of dollars in savings annually.

Compliant and Transparent Pricing

Unlike outdated surcharge programs that may violate processing rules, Buyer's Choice ensures full compliance with Visa, Mastercard, and other card networks. The program is built with clear, upfront pricing, ensuring customers understand their options without any hidden fees.

Encourages Cash and Debit Transactions

Buyer's Choice incentivizes customers to pay with cash or debit by offering a lower price. This helps businesses reduce their reliance on credit card payments, leading to fewer chargebacks and processing-related headaches.

Works for a Wide Range of Industries

From retail stores and restaurants to service-based businesses and professional practices, Buyer's Choice can be customized to fit different industries. Whether you run an auto repair shop, medical office, or local café, this program helps eliminate unnecessary costs without disrupting operations.

No Additional Costs for Merchants

Unlike other solutions that require expensive equipment or software upgrades, Buyer's Choice works with most existing payment systems. Retriever handles the setup and compliance, making it an easy and cost-effective transition.

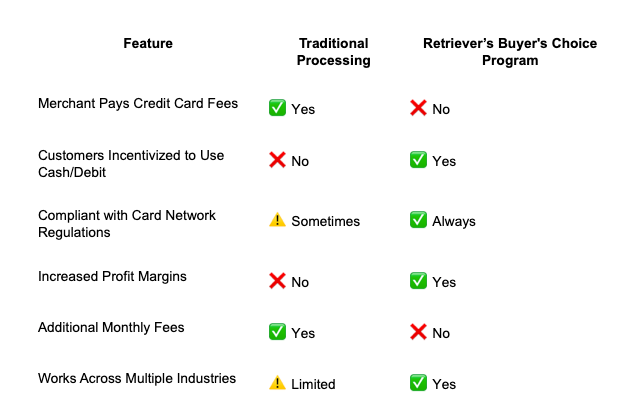

How Buyer's Choice Compares to Traditional Credit Card Processing

Many business owners are unaware of how much money they lose each year due to processing fees. A switch to Buyer's Choice eliminates these unnecessary costs and puts money back into their business.

Who Can Benefit From Buyer's Choice?

Restaurants and Cafés

With increasing credit card usage, small food businesses lose thousands in fees every year. Buyer's Choice allows them to keep more of their earnings while maintaining compliance with card regulations.

Auto Repair Shops

Shops that process high-ticket transactions see major savings by eliminating credit card fees. The program is particularly beneficial for mechanics, body shops, and tire centers.

Medical and Dental Practices

Healthcare providers often struggle with credit card processing fees, especially for large transactions. Buyer's Choice helps offset costs while maintaining patient satisfaction.

Retail Stores

From small boutiques to high-volume retail chains, Buyer's Choice helps increase profitability while keeping transactions simple and transparent for customers.

Home Service Providers

Contractors, electricians, HVAC companies, and other service providers benefit by ensuring that large invoices no longer include hidden processing fees.

How to Get Started with Buyer's Choice

Switching to Buyer's Choice is fast and hassle-free. Retriever provides businesses with:

- A full compliance review to ensure all transactions follow card network rules.

- Signage and disclosures to inform customers about pricing options.

- Seamless integration with existing payment processing systems.

- Ongoing support and customer service to handle any questions or concerns.

Retriever’s team ensures a smooth transition so business owners can start saving money immediately.

Is Buyer's Choice the Right Fit for Your Business?

If you're tired of watching credit card fees eat into your revenue, Buyer's Choice offers a proven and compliant solution to eliminate those costs. Whether you process $5,000 or $500,000 in credit card transactions each month, keeping more of your hard-earned money is always a smart move.

Contact

Retriever today to learn how Buyer's Choice can help

transform your payment processing strategy and increase your profits.